One of the reasons the housing market has rebounded is attributed to the historically low interest rates. Long term mortgage rates will likely climb assuming the Fed cuts back on bond purchases. With the the transition of Ben Bernanke to the new Fed Chairman Janet Yellen, it has been widely expected that the tapering of bond purchases would in fact change. However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering:

One of the reasons the housing market has rebounded is attributed to the historically low interest rates. Long term mortgage rates will likely climb assuming the Fed cuts back on bond purchases. With the the transition of Ben Bernanke to the new Fed Chairman Janet Yellen, it has been widely expected that the tapering of bond purchases would in fact change. However, in her testimony in front of the Financial Services Committee last week, Yellen made it quite clear that she will in fact continue the current pace of tapering:

“In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities.

At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.”

What does that mean to a prospective purchaser? Currently, Freddie Mac’s 30 year rate is at 4.28%. Here are the projected interest rates for this time next year.

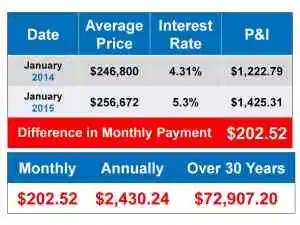

With interest rates projected to rise between 5.1% and 5.4% in Q1 of 2015 according to Fannie Mae, NAR, Freddie Mac and the Mortgage Bankers Association, it is important for prospective home buyers to understand the financial affect on their purchaser. Here is an example of what to expect with an interest rate rise of 1.0% and how it affects the monthly interest payments plus the annual and 30-year costs for a $250,000 purchase. In this area, the average sales price is closer to $750,000 which triples the affect. In an ideal world, buyers will find a home in 2014 …