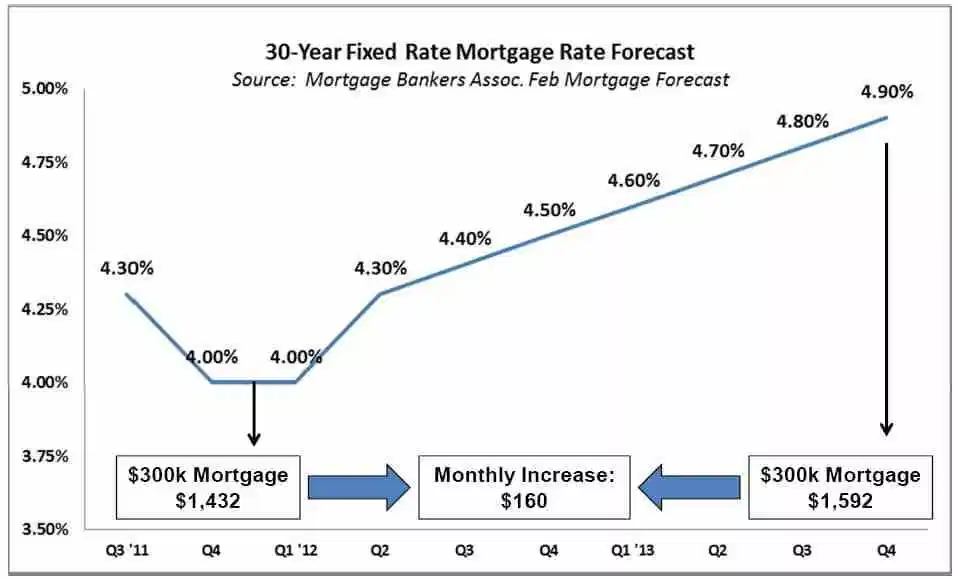

March 24, 2012 – When considering a possible sale or purchase of DC real estate, or anywhere for that matter … one of the most critical factors of course is the amount of interest that will be charged on the loan. You may have noticed in some recent headlines that mortgage rates may be embarking on their slow but steady climb upward that economists have been predicting for some time. First, understand we should not necessarily be afraid of an uptick in rates. This will not cause the housing market to come to a grinding halt. In fact, upward-moving interest rates are indicative of a recovering economy and housing market—facts that we can see not only in interest rates, but in other economic indicators as well. Further, we should also remember that today’s rates continue to be historically very low, and are expected to remain so through 2013. The Mortgage Bankers Association forecast for the end of 2013, at 4.9 percent, is still low compared to the rates of prior decades.

However, upward pressure on rates that is expected to continue for the foreseeable future may present a near-term opportunity to take action on a housing-related decision before inching rates make a significant impact on your monthly payments. As this chart provided by the Mortgage Bankers Association highlights, qualified buyers have a near-term opportunity to take advantage of current rates before the projected increases.